How to Start a New QuickBooks File for an IRS Audit

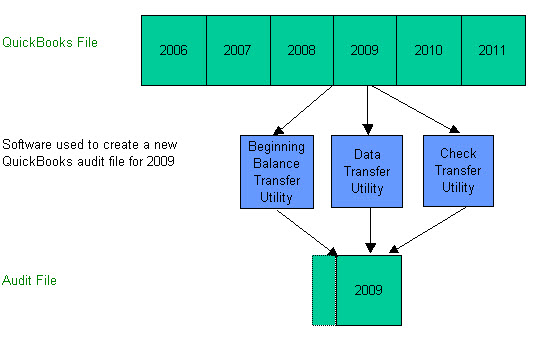

If you are being audited by the IRS, you can create a new QuickBooks file containing just the year under audit. Consult with the auditor to

make sure this file will be acceptable before you create this file. Following is a summary of the process needed to start an audit file.

1. Start a new empty file with all of you existing list names (accounts, customers, vendors, items etc) in it.

See the "Preparation" section at http://www.q2q.us/bbtuoverview.htm for two different ways to start the new file.

2. Transfer the Beginning Balances as of the year-end just before the year being audited (12/31/08 in this example) to the audit file.

This transfer can be made using our Beginning Balance Transfer Utility if you are on the accrual basis of accounting.

If you are on the cash basis of accounting, you will have to enter the beginning balances manually.

Beginning Balances include open AR, unpaid AP, inventory and trial balance.

3. Transfer transactions for the year under audit (2009 in this example) to the audit file using our Data Transfer Utility and

Check Transfer Utility programs.

Following is a flowchart of this process.

This process does not transfer the audit trail to the new file. The audit trail will only include the transactions transferred to the new file and it

will not show any prior history for the transferred transactions.

The following programs are needed to create the audit file.

1. Beginning Balance Transfer Utility. For more information about this program, see

http://www.q2q.us/bbtuoverview.htm and click on the links at the top of the

page. This program is $129.

2. Data Transfer Utility. For more information about this program, please visit:

a. Our home page: http://www.q2q.us/

b. The main page for the Data Transfer Utility:

http://www.q2q.us/dtuoverview.htm

c. The download page for pricing information and a free trial:

http://www.q2q.us/download.htm The price is $149.

d. For video clips of the program:

http://www.q2q.us/dtuvideos.htm

e. For tables of what can and cannot be transferred:

http://www.q2q.us/dtudatatypes.htm

Be sure to read over the Transfer Strategies document in the Help section of

the Data Transfer Utility program before making any transfer with it.

3. Check Transfer Utility. This program can transfer payroll checks and payroll and sales tax liability checks , if

needed. See http://www.q2q.us/ctuoverview.htm . Note that Data Transfer Utility version 12 and later can transfer

Sales Tax Payment checks. This program is $49 of you purchase the Data Transfer Utility program.

Use of the following program is optional.

4. Data Remover. This program can delete list names (customers, vendors, items, employees) that are not used (needed) in

the audit file. See http://www.q2q.us/drmoverview.htmfor more in how this process works.If you have any comments or questions, email us at mailto:support@q2q.us